A Comparison of Keeper Tax and TurboTax for Tax Preparation

Tax preparation is a financial obligation that confronts many individuals and businesses each year. As such, it is critical to understand the different options available to ensure taxes are accurately and efficiently prepared. Two of the most popular options are Keeper Tax and TurboTax, both of which provide a range of services and features. This paper will compare Keeper Tax and TurboTax to provide a comprehensive overview of their respective advantages and disadvantages.

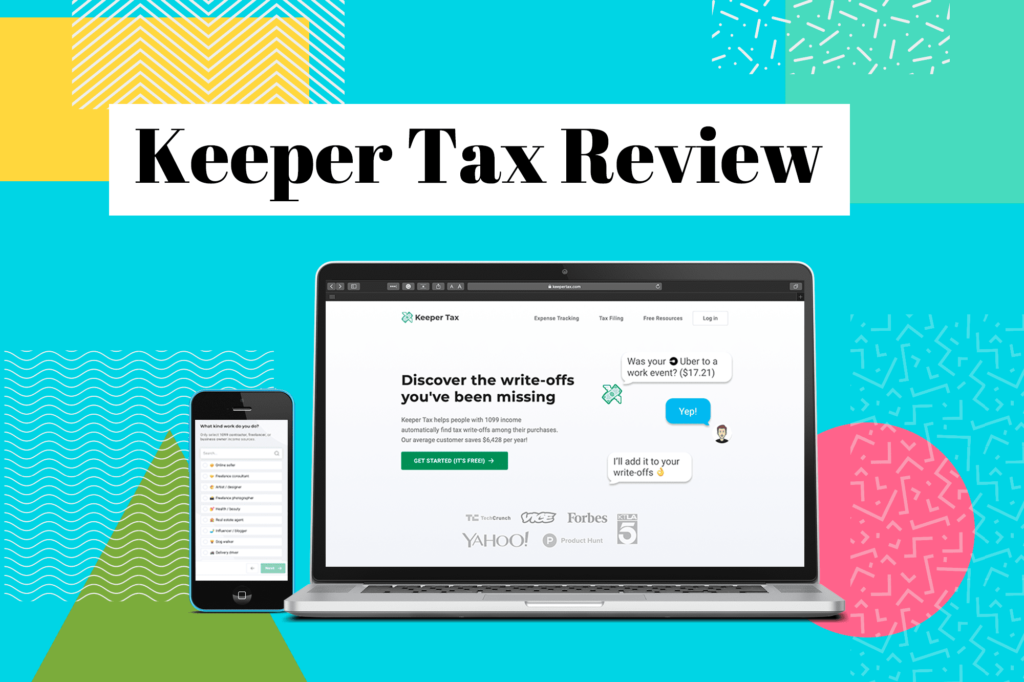

Overview of Keeper Tax and TurboTax

Keeper Tax and TurboTax are two of the most popular tax preparation services available today. Keeper Tax is a web-based software platform that provides a comprehensive range of tax preparation services, including tax filing and payment options. It is designed to provide an easy-to-use and secure online tax filing experience. TurboTax is also a web-based software platform designed to provide a comprehensive range of tax filing services, including preparation, filing, payment, and refunds. Both services are designed to provide a streamlined and efficient tax filing experience.

Keeper Tax and TurboTax both offer a range of pricing options, depending on the complexity of the tax return and the services required. Keeper Tax has a free version, which provides basic tax filing services and is suitable for simple tax returns, as well as a paid version for more complex returns. The paid version of Keeper Tax is slightly cheaper than TurboTax, at $19.99, compared to TurboTax’s $29.99. However, TurboTax also offers a free version, which is suitable for simple tax returns.

Accuracy of Keeper Tax and TurboTax

Keeper Tax and TurboTax both provide accurate and efficient tax filing services. Keeper Tax has a comprehensive suite of tools and features, including a tax calculator, tax guidance, and a tax audit tool. These features ensure that tax returns are accurately prepared. TurboTax also has a range of features designed to ensure accuracy, including an error checker, a deduction finder, and an audit alert system.

User Experience of Keeper Tax and TurboTax

Keeper Tax and TurboTax both provide a user-friendly experience. Keeper Tax has an intuitive and easy-to-use interface that is designed to be user friendly and provide a quick and efficient filing experience. TurboTax also has a user-friendly interface, with step-by-step guidance and tools designed to simplify the tax filing process.

Conclusion

Keeper Tax and TurboTax offer a comprehensive range of tax filing services and features. While both services are accurate and efficient, Keeper Tax is slightly cheaper and provides a more user-friendly experience. However, TurboTax also has a range of features and tools designed to simplify the filing process. Ultimately, the choice between Keeper Tax and TurboTax will depend on the complexity of the tax return, the services required, and the user’s preference.