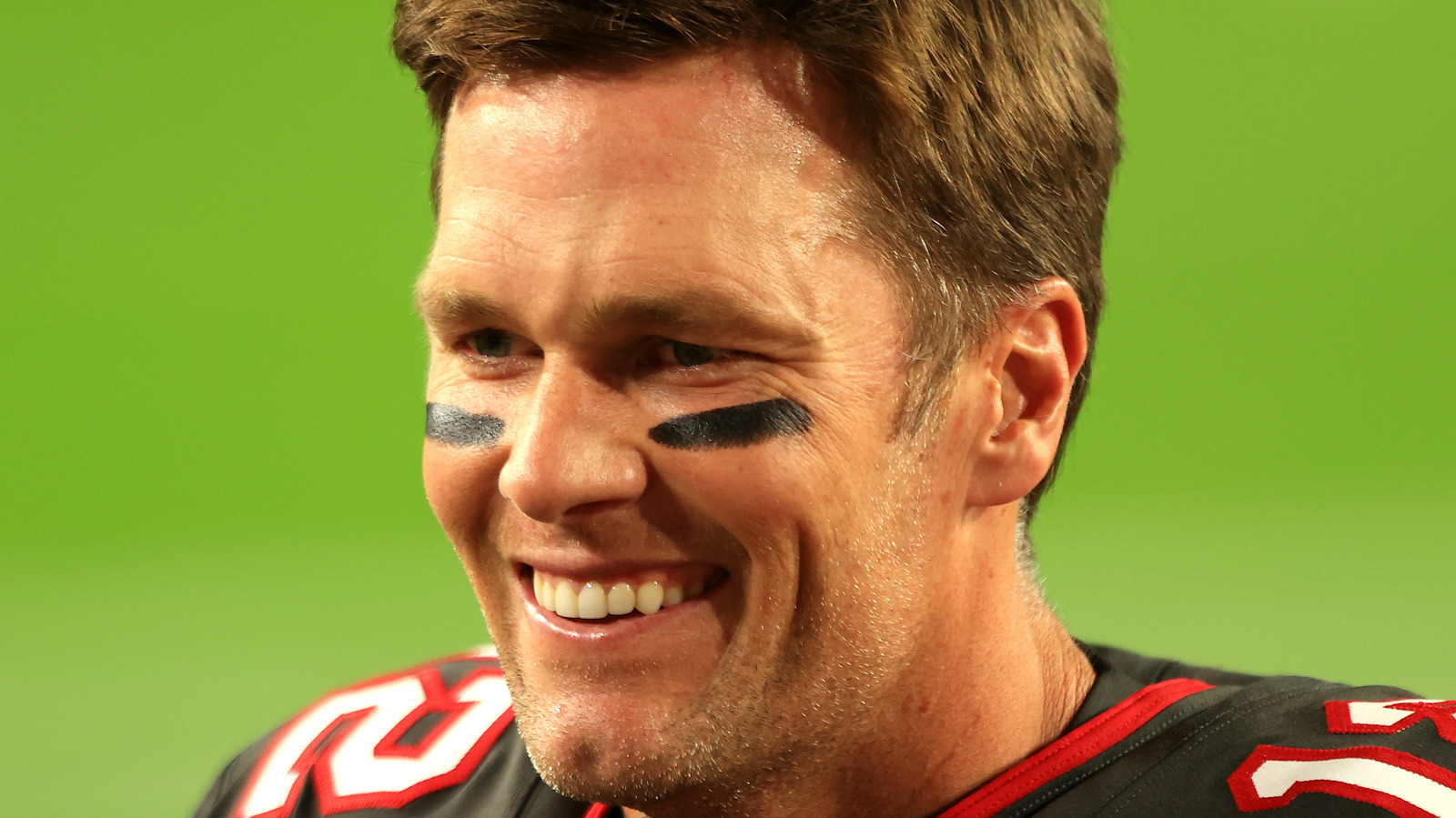

Tom Brady’s $170M Series Funded by Kleiner Perkins and MatneyTech

Tom Brady, the legendary quarterback of the New England Patriots, recently announced a new venture backed by venture capitalists Kleiner Perkins and MatneyTech to the tune of $170M. This new series, founded by Brady, is intended to be a platform for a variety of investments and business opportunities. In this article, we will explore the details of the series, discuss the potential implications, and examine the venture capital landscape.

Overview of Tom Brady’s $170M Series

Tom Brady, the legendary quarterback of the New England Patriots, recently announced a new venture backed by venture capitalists Kleiner Perkins and MatneyTech to the tune of $170M. This new series, founded by Brady, is intended to be a platform for a variety of investments and business opportunities. The series will be focused on technology, healthcare, and consumer products sectors. Brady has said that he plans to use his platform to help launch and foster new ideas, as well as support existing companies.

Kleiner Perkins and MatneyTech’s Investment

Kleiner Perkins and MatneyTech are two of the most prominent venture capital firms in the world. They have invested heavily in technology and healthcare companies, and their investments in Brady’s series will likely be no different. The two firms have already committed a combined $170M to the series and are expected to provide additional support in the future. They have also indicated that they will be looking for additional partners to join the series in order to increase its capital base.

Potential Implications of the Series

The potential implications of Brady’s series are far-reaching. It is likely that the series will attract an array of investors, entrepreneurs, and business leaders. This could lead to a new wave of innovation in the technology, healthcare, and consumer products sectors. Additionally, the series could open up new opportunities for small businesses in these industries. Finally, the series could potentially provide a platform for more diverse investments and more innovative business models.

Examining the Venture Capital Landscape

The venture capital landscape is highly competitive. Firms must compete for scarce resources and limited capital. As such, it is important to understand the dynamics of the industry in order to be successful. Brady’s series is an example of how venture capital firms can use their resources to invest in innovative ideas and businesses. It also provides a platform for new investments and could lead to the emergence of new venture capital firms in the future.

Conclusion

Tom Brady’s $170M series is an exciting development in the venture capital landscape. It is backed by two of the most prominent venture capital firms in the world and has the potential to open up new opportunities for investors, entrepreneurs, and business leaders. Moreover, it could lead to the emergence of new venture capital firms and provide a platform for more diverse investments and more innovative business models. All in all, Brady’s series is a promising development and could lead to a new wave of innovation in the technology, healthcare, and consumer products sectors.